Although not entirely trading pit related, one of the finest documentations on the shift from floor to computer trading is a 1996 book on the

Johannesburg Stock Exchange entitled The Floor, written by David Gleason with photography by Graeme Williams. The book is hard to find and mine was shipped from the UK if I recall correctly, amazon currently shows no listings although abe.com shows a copy at a bookshop in Johannesburg.

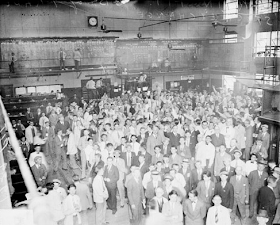

The JSE has a rich history largely based upon mining and metals which continues, albeit electronically, as the trading floor closed in 1996 which the book does an excellent job of capturing the final days. Perhaps the best feature is the photography as it illustrates the clubby culture and traditions of the those who worked on the trading floor. Ironically, the JSE contined to use chalkboards for price display right up to the point trading shifted entirely to the computer.

The author Gleason wrote the following late in the book and it applies well to all trading floors:

"Those old, hard drinking, easily cursing, wickedly tempered, curiously generous traders are yesterday's men and the place where they did their raucous business is silent now. The floor has gone. Never again will pandemonium erupt as bad news is rushed in hurriedly from the customer dealers; never again will wild scenes of frenzy and demand take control as traders scream orders for a newly listed stock.

The computer screen is the silent replacement. The click of the keyboard is still the sound of money. Oh, smoke still drifts across the trading rooms, bad language punctuates every sentence, the phones still ring, and the old exclamatories remain commonplace - but, somehow, it isn't quite the same. Where there was apparent chaos, there is order. Where a few men might 'run' the market in a liquid, well-traded stock, now everyone can see what's happening. Status, length of service, respect - these no longer count for much. Now, it is speed of response, swiftness of execution, ability to access lines or sell concepts.

The Floor is dead. Long live the screen."