I approached

The Asylum with a lot of skepticism but finished it quite satisfied with almost all of the near 400 pages. To get that satisfaction though I had to dismiss a lot of the attention getting tales of lewd floor behavior and focus on all the characters who built and guided NYMEX to what it was, for better or worse.

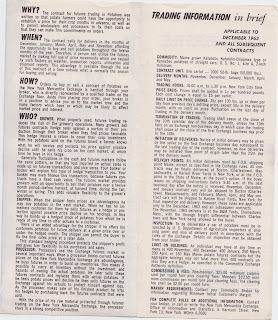

What most people don't realize is that before NYMEX began trading energy, their dominant contract was Maine Potatoes which closed after a default in 1976. After the Potato contract was delisted, NYMEX primarily had a platinum contract before diversifying into their energy listings first with

heating oil which took a great effort to begin trading. Once heating oil caught success, the CBOT and NYMEX competed to launch a

crude oil contract simultaneously but due to problems of the CBOT's contract, NYMEX emerged the winner.

The entire concept of listing energy futures at a time of OPEC dominance was really interesting and well explained. It seemed that

OPEC was so unconcerned w/a small entity like NYMEX that they never even tried to get in the way of preventing such a market place being established. As could be expected, once the exchange gained prominence it also began numerous power struggles to lead the exchange through various market cycles and ultimately into their IPO then eventual purchase by CME.

The various NYMEX characters were all intriguing, I felt equally for their accomplishments and drive as their faults and in certain cases, amorality. It's tough for a random observer to keep the names straight as there are quite a few but I was able to follow along after reading news stories throughout the years w/some of the characters involved. The author was a former WSJ reporter who pieced together interviews over seven years and the best part of the book was it was filled with a wide range of perspectives.

My main faults with the book were that the perspectives were mostly brokers, those with ties to brokerages, clerks or corporate workers rather than including a lot of those who actually trade as locals. The book also had a lot of cheap attention grabbers mostly regarding various sexcapades or mistresses sometimes w/names attached or not left to the imagination. During the intro the author noted that some spoke to her not expected things to be published but they nonetheless made it into the book, hence a warning never to say anything to a reporter unless you can live with it being printed.