Had a chance to rewatch Rogue Trader on DVD and here is a gross overanalysis of some observations I made:

10:45 the Delifrance was across directly from the entrance to SIMEX and traders walking in back were going to the actual entrance.

12:05 entrance to trading floor was a bit absurd that everyone was briefed minutes before beginning work on the trading floor. I understand it’s the movies but still was a bit ridiculous.

19:30 Leeson discusses the error and hiding it w/a clerk which wasn’t true as he didn’t inform anyone of the problems.

20:33 The trader which one of the Barings brokers fights with is Danny "Bubble" Argyropoulos, a real life friend of Leeson’s on the SIMEX floor, and I believe the trader holding him back is Rob “Ches” Lemming who was formerly employed by Barings.

22:38 again the clerk informs Leeson of the errors which is false as only he know of it.

24:00 the name and firm of the large customer were changed.

26:38 most ridiculous part of the film when the traders high five and hug each other after filling an order. Never happened since the trading began in the pits back in the mid 1800s.

28:00 again shows clerk complicit and knowledgeable about breaking even in the error account which no one else knew about.

30:25 Bubble has a few words w/Leeson as he walks on the trading floor

30:55 I don’t think anyone trades like the large customer did supposedly on the yacht.

31:33 legging the option spread was again not discussed w/others on the floor

32:55 bonus of 135,000 pounds on 10 million in profit, it’s amazing how little a slice employees get at banks

37:55 Bubble is said to work at a different firm than he actually did and is depicted as a drinker when he was in actuality a nondrinker

40:00 Bubble wasn’t with Leeson when Leeson got arrested for mooning some women at a bar (pretty sure he wasn’t atleast)

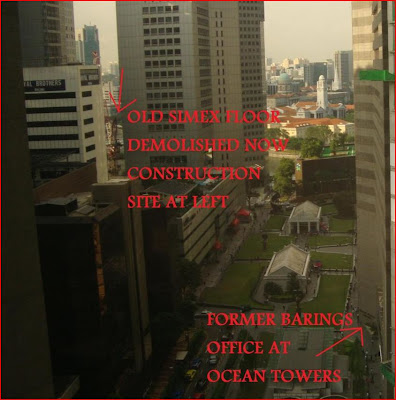

1:02:18 Barings offices were located at Ocean Towers at 20 Raffles Place (shown early in the movie) and not the indicated address. Moments later he misspells “Spear Leeds and Kellogg” as “Speer, Leads and Kellagg” but this is likely on purpose as SLK probably didn’t like being depicted in the movie, even innocently.

1:03:31 The cut and paste document forgery doesn’t get mentioned by Leeson in his autobiography and is a great omission on his part although documented in other books about him.

1:10:45 Bubble is depicted as trading outside of the pit which can’t happen, I know that it wasn’t an actual trade depicted but still…

1:22:05 Bubble can be seen in the background flashing handsignals on a trading desk to the pit

1:22:40 Leeson yells, “sorry, money” to one of his superiors and I find that as the second most ridiculous part of the movie because the concept of actual, real money wasn’t really ever mention on any trading floor as if there was a taboo against it.

1:36:00 Probably the third most ridiculous part of the movie was Leeson saying and signaling “two fifty bid on 100” to the photographers upon arrest in Frankfurt.

Other comments:

-With exception of Barings jackets, no other firm jackets were actually depicted although the most of the local traders wore red. At the CME most locals also wore red because it was the free jacket that was issued upon becoming a member.

-The trading floor depicted is not the actual SIMEX trading floor which was much darker, dirtier and crowded.

-The electronic quote boards were poorly depicted in the movie as it was lots of small numbers rather than one huge number on the board.

I know there are even more points of the movie to overanalyze but it's gonna have to wait until I get to view it again.